Learn how fees work at Interac

Interac e-Transfer Fees for Financial Institutions

Please note, the Interac e-Transfer fees listed below are wholesale fees paid by financial institutions. Interac does not charge Interac e-Transfer fees directly to end customers.

If you are a consumer or a business owner and have specific questions about Interac e-Transfer fees, please contact your financial institution.

Interac e-Transfer Transaction Fees

Interac e-Transfer Send Money & Retail Request Money:

- Non-on-us Transaction: $0.08/transaction

- On-us Transaction: $0.04/transaction

- Request Money Fulfillment Fee: Requester’s Participant will be required to pay the Responder’s Participant with an additional $0.10 per fulfillment

- Request Money Initiation Fee: Requester’s Participant will be charged additional $0.01/initiation, regardless of whether such transaction is fulfilled or not

Interac e-Transfer Business Request Money

Ad valorem option:

- Requester’s Participant Fee: 35 bps* (of which 25 bps* is paid to Responder’s Participant).

- Ad-valorem fee is capped at $3.50/transaction

Flat Fee (based on non-retail customer meeting qualification criteria):

- Requester’s Participant Fee: $0.35 / transaction (of which $0.25 is paid to Responder’s Participant).

- Participant will pay a one-time onboarding fee of $2,000.00 per non-retail customer meeting qualification criteria.

High-volume Recipient Fee (Send Money Transactions)

- Receiving Participant Fee: $0.05/transaction

SMS Fees

- $0.015 per SMS notification

Interac e-Transfer Bulk Fees

Bulk Payables:

- Transaction Processing fee – $0.05 / transaction

Bulk Receivables:

- Transaction Processing fee – $0.02 / request, $0.03 / fulfillment

- Fulfillment Fee – Requestor Participant will be required to pay the Responder Participant with an additional $0.10 per fulfillment

File and Transaction Fees (Legacy) – Regular Processing:

- File Processing fee – $5.00 / file

- Transaction Processing fee – $0.07 / transaction

File and Transaction Fees (Legacy) – Priority Processing:

- File Processing fee – No charge

- Transaction Process fee – $0.32 / transaction

File and Transaction Fees (Legacy) – Custom Notification:

- Transaction processing fee – $0.05 / transaction

Sundry Fees, applicable to both Interac e-Transfer and Interac e-Transfer Bulk

Implementation and Onboarding Support Fees

-

- $250/hour

- Bank of hours billed at $220/hour with minimum 250 hours bank.

One-time Onboarding Fees

-

- $50,000 for a direct connection

- $5,000 for an indirect connection

Monthly Operating Fees

-

- $20,000 for each direct connection

- $1,500 for each of the first 9 indirect connections

- $500 for each indirect connection beyond 9

Monthly Network/Telecom Fee (Charged by the telecom companies)

-

- $1,000 – $10,000 per site

Test Environment Maintenance Fee:

- $150/day

Interac e-Transfer Operational Support Activities:

- $250/hour

-

Interac Debit

Switch Fee and Mobile Service Fee

- Switch Fee:

- Interac Debit ABM Withdrawals: $0.015881

- Interac Debit (Chip & PIN, card contactless): $0.013985

- Mobile Service Fee:

- Interac Debit (mobile contactless): $0.013985

- Switch Fee:

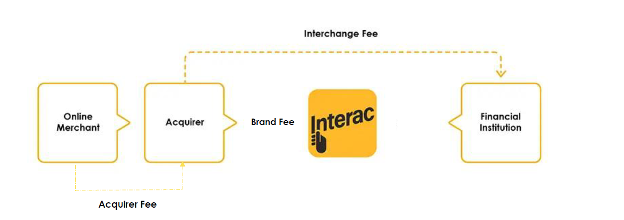

Fees for Interac Debit for eCommerce (InApp/InBrowser) with Apple Pay and Google Pay

Issuer Switch Fee: $0.013985

Acquirer Service Fee: $0.025

Interchange Fee

Product Interchange Fee Applicability ABM Withdrawals $0.75 flat-fee Per completed cash withdrawal transaction paid by Issuer to Acquirer Contactless Payments See Contactless Payment Interchange Structure tab below Per completed card and mobile debit contactless purchase transaction, and based on qualifying tier of merchant from which transactions originate; paid by Acquirer to Issuer. Interac Debit for eCommerce (InApp/Browser) with Apple Pay* and Google Pay** See Interac Debit for eCommerce (InApp/InBrowser) with Apple Pay and Google Pay Interchange Fee tab below Per completed purchase transaction and based on qualifying tier of merchant transactions; paid by Acquirer to Issuer Contactless Payment Interchange Structure

Transaction Amount Interchange Tiers Flat-fee Per Transaction Criteria for Merchant Qualification Transaction from $0.01 to $100.00 Tier 1

Low-ticket Merchants$0.020 Merchants in the following qualifying segments: - Fast Food Restaurants (MCC 5814)

- Variety Stores (MCC 5331)

- Movie Theatres (MCC 7832)

- Convenience Stores (MCC 5499)

- Bakeries (MCC 5462)

- Dairy Product Stores (MCC 5451)

- Limousines and Taxicabs (MCC 4121)

- News Dealers and Newsstands (MCC 5994)

- Charitable and Social Services Organizations (MCC 8398)

- Transportation – Suburban and Local Commuter Passenger (MCC 4111)

- Toll Roads/Bridges (MCC 4784)

- Passenger Railways (MCC 4112)

- Bus Lines (MCC 4131)*

- Candy, Nut, Confectionary Stores (MCC 5441)

- Auto Store, Home Supply Stores (MCC 5531)

- Electric Vehicle Charging (MCC 5552)

- Caterers (MCC 5811)

- Cleaning, Garment, and Laundry Services (MCC 7210)

- Laundry Services-Family and Commercial (MCC 7211)

- Automobile Parking Lots and Garages (MCC 7523)

- Car Washes (MCC 7542)

- Nursing and Personal Care Facilities (MCC 8050)

- Hospitals (MCC 8062)

Tier 2

High-volume Merchants$0.025 Merchants and merchant enterprises that meet the minimum annual transaction volume threshold of 20 million Interac Debit Contactless transactions, based on transaction volume in the previous calendar year. Tier 3

All other Merchants$0.035 Merchants that do not otherwise qualify for Tier 1 and Tier 2. Transaction from $100.01 to $250.00 Tier 4

All Merchants$0.055 All Merchants Interac Debit for eCommerce (InApp/InBrowser) with Apple Pay and Google Pay Interchange Structure

Interchange Tier Interchange Fee Criteria for Qualifications Tier 1 (Default) 60 bps (0.6%) per transaction (capped $300 at $1.80) Merchants with up to 500,000 transactions in the previous calendar year Tier 2 57.5 bps (0.575%) per transaction (capped $300 at $1.725) Merchants with 500,001 -1,000,000 transactions in the previous calendar year in the following MCCs:

– Local and Suburban Commuter Passenger Transportation (MCC 4111)

– Wholesale Clubs (MCC 5300)

– Discount Stores (MCC 5310)

– Grocery Stores and Supermarkets (MCC 5411)

– Taxicabs and Limousines (MCC 4121)

– Clothing and Accessories (MCC 5611,5137, 5621, 5631, 5641, 5651,5661, 5691)

– Package Stores Beer, Wine, Liquor (MCC 5921)

– Parking Lots and Garages (MCC 7523)Tier 3 55 bps (0.55%) per transaction (capped $300 at $1.65) Merchants with greater than 1,000,000 transactions in the previous calendar year in the following MCCs:

– Local and Suburban Commuter Passenger Transportation (MCC 4111)

– Wholesale Clubs (MCC 5300)

– Discount Stores (MCC 5310)

– Grocery Stores and Supermarkets (MCC 5411)

– Taxicabs and Limousines (MCC 4121)

– Clothing and Accessories (MCC 5611,5137, 5621, 5631, 5641, 5651,5661, 5691)

– Package Stores Beer, Wine, Liquor (MCC 5921)

– Parking Lots and Garages (MCC 7523)Tier 4 $0.35/per transaction ‘Tax Payments’ MCC: 9311

Interac Direct

Interac Direct Pricing Structure

Fee Structure/elements Range Applicability Interchange Fee 55 to 70 Basis Points* Per completed Interac Direct transaction paid by the Acquirer to Issuer Interac Brand Fee 10 Basis Points Per initiated Interac Direct transaction paid by the Acquirer to Interac Corp. *Applicable Interchange Fees are subject to qualifying criteria and may vary based on merchant setup or merchant categories.

Certain Merchant Category Codes may qualify for specialized pricing. Please contact your acquirer for more information.

Learn more about how fees work

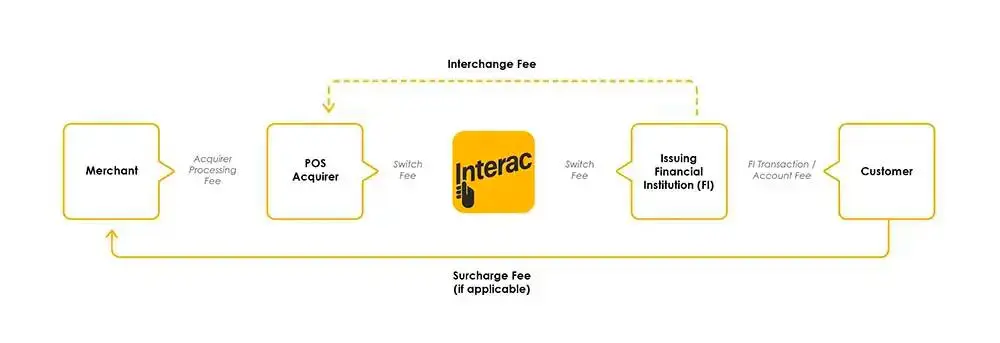

ABM Withdrawals

Switch fee – ABM Acquirers and Issuing FIs that are participants of Interac Corp. pay a wholesale, flat-rate switch fee for every Interac Cash transaction message that they send to the Interac network. It is an annual, low-cost fee set on a cost recovery basis, and it is the only fee charged by Interac Corp. in connection with Interac Cash transactions.

Interchange fee – Interchange is a fee that a customer’s financial institution pays to the ABM Acquirer and it is intended to compensate the ABM Acquirer or ABM owner/operator for the service of providing cash to the Issuing FI’s customer. It is paid for every approved cash withdrawal transaction processed through the Interac network. While Interac Corp. has a role in setting the interchange fee rate, it does not receive any revenue from this fee.

Surcharge fee – ABM owners/operators may impose a surcharge (e.g., $2.00) on customers that use their ABMs. An ABM surcharge fee is also known as a convenience fee. As prescribed by the Interac Consent Order issued by the Competition Tribunal, Interac Corp. may not restrict the levying of a surcharge. If imposed, the surcharge amount must be properly disclosed to the customer, and the customer must be provided with the option of cancelling the transaction without cost if they do not wish to pay the surcharge. The amount of the surcharge is determined at the discretion of each ABM owner/operator.

Acquirer processing fee – ABM owners/operators pay a processing fee to the ABM Acquirer that provides them with connection services to the Interac network and the fee may include costs related to other services. The fee varies depending on individual contracts that ABM owners/operators have with their ABM Acquirers or connection service providers.

FI transaction/account fee – Customers may be charged a fee by their financial institution (FI) directly from their bank account for Interac Cash transactions (i.e., use of an ABM for a cash withdrawal that is not operated by their own FI). The application and amount of these fees vary and reflect the individual business decisions made by each individual FI. FIs may also charge a regular transaction account fee for Interac Cash transactions. These FI transaction/account fees may be included in a customer’s bank account package offered by their FI.

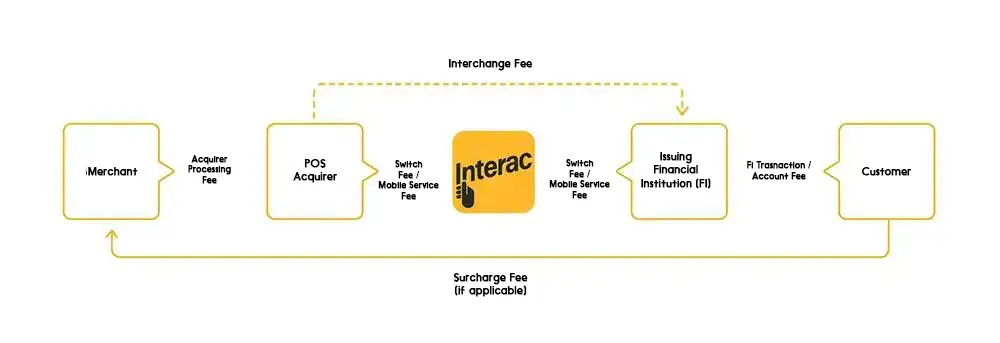

Interac Debit (Chip & PIN, Card Contactless and Mobile Contactless)

Switch Fee / Mobile Service Fee – POS Acquirers and Issuing FIs that are participants of Interac Corp. pay a wholesale, flat-rate fee for eligible Interac Chip & PIN and card contactless (Switch Fee) and mobile contactless (Mobile Service Fee) transaction message that they send to the Interac network. It is an annual, low-cost fee set on a cost recovery basis, and it is the only fee charged by Interac Corp. in connection with Interac Debit transactions.

Interchange fee – Interchange is a fee that a POS Acquirer pays to the customer’s financial institution to balance the costs and benefits of offering the service to customers. Interchange for Interac Debit is currently set at zero. Beginning April 2016, a new interchange pricing structure will be introduced for Interac Flash. While Interac Corp has a role is setting the interchange fee rate, it will not receive any revenue from the fee.

Surcharge fee – The surcharge fee must be capped at $0.25. However, if debit services from more than one payment network are offered at the POS, the surcharge amount must not exceed the other payment network’s surcharge amount. If imposed, the surcharge fee must be printed on the transaction record, and must be applied by the merchant’s applicable Acquirer. The surcharge fee must be properly disclosed to the customer, and the customer must be provided with the option of cancelling the transaction without cost if they do not wish to pay the surcharge. Merchants may not directly apply a surcharge to any cardholder for the use of the Interac Debit Service.

Acquirer processing fee – Merchants pay a processing fee to the POS Acquirers that provide connection services to the Interac network, and the fee may include costs related to other services. The fee varies depending on individual contracts that merchants have with their POS Acquirers or connection service providers.

FI transaction/account fee – Customers may be charged a regular transaction account fee by their financial institution (FI) directly from their bank account for Interac Debit transactions. The application and amount of this fee varies and reflect the individual business decisions made by FIs. The fee may be included in a customer’s bank account package offered by their FI.

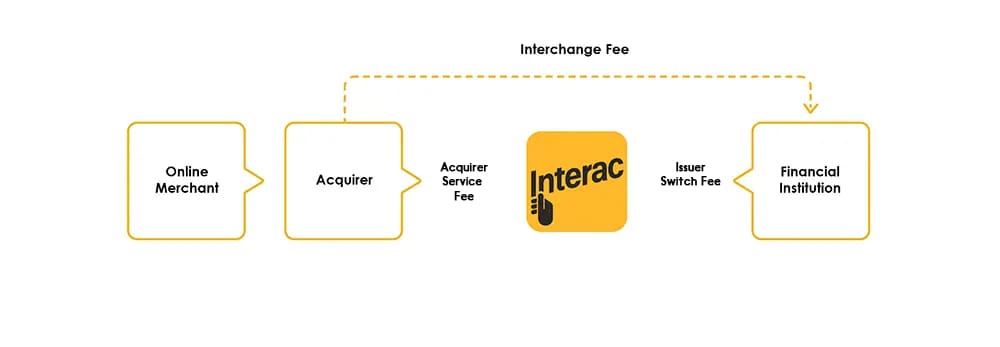

Fees for Interac Debit for eCommerce (InApp/InBrowser) with Apple Pay and Google Pay

Issuer Switch Fee – Participating issuers pay a wholesale, flat-rate transaction fee to Interac for eligible Interac Debit for eCommerce (InApp/InBrowser) transactions with Apple Pay and Google Pay.

Acquirer Service Fee – Participating acquirers pay a wholesale, flat-rate transaction fee to Interac for eligible Interac Debit for eCommerce (InApp/InBrowser) transactions with Apple Pay and Google Pay.

Interchange fee – Interchange is a fee that an acquirer pays to issuers for each transaction that they initiate and that is subsequently approved by the issuer. Interac will calculate the interchange fee on a per transaction basis. While Interac Corp. has a role in setting the interchange fee rate, it will not receive any revenue from the fee.

Surcharge fee – The option to impose a surcharge on remote transactions using the Interac Mobile Debit (In-App/In-Browser) Service will not be permissible to align with market standards.

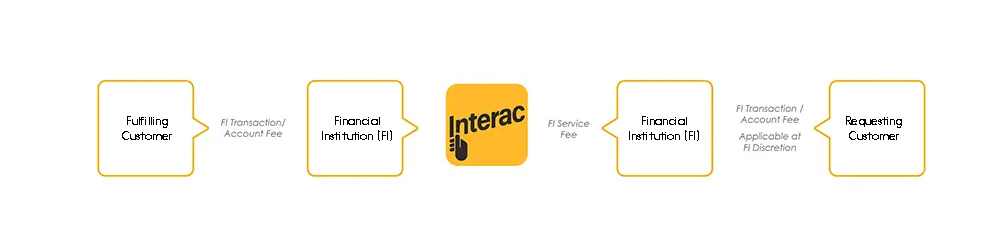

Interac e-Transfer (Send Money)

FI service fee – As of November 1, 2025, Financial institutions (FIs) pay a wholesale flat-fee to Interac Corp. for each Interac e-Transfer transaction they send on behalf of their customers.

FI transaction/account fee – Financial institutions (FIs) may charge their customers a fee for sending an Interac e-Transfer transaction. Depending on the banking package, these could be free at your financial institution.

The application and amount of these fees vary and reflect business decisions made by each individual FI. FIs may also charge their customers a regular transaction account fee for Interac e-Transfer transactions. These FI transaction/account fees may be included in a customer’s bank account package offered by their FI.

Interac e-Transfer (Request Money)

FI service fee – As of November 1, 2025, Financial institutions (FIs) pay a wholesale flat-fee to Interac Corp. for each Interac e-Transfer transaction they send on behalf of their customers.

FI transaction/account fee – Financial institutions (FIs) may charge their customers a fee for sending an Interac e-Transfer transaction. Depending on the banking package, these could be free at your financial institution.

The application and amount of these fees vary and reflect business decisions made by each individual FI. FIs may also charge their customers a regular transaction account fee for Interac e-Transfer transactions. These FI transaction/account fees may be included in a customer’s bank account package offered by their FI.

Interac Direct

Interchange Fee – An ad valorem fee payable by Acquirers directly to Issuers for every completed transaction initiated and subsequently approved by the Issuers on the Interac Direct service. While Interac Corp. has a role in setting the Interchange Fee rate, it will not receive any revenue from the Interchange Fee.

Interac Brand Fee – An ad valorem fee payable by Acquirers directly to Interac Corp. for every transaction initiated on the Interac Direct service. The Interac Brand Fee is the only fee charged by Interac Corp. in connection with Interac Direct transactions.

*For a list of compatible Apple Pay devices see support.apple.com/en-ca/. Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Touch ID are trademarks of Apple Inc.

**Google, Google Pay and the Google logo are trademarks of Google INC.

***All trademarks are the property of their respective owners.