For the third year in a row, Interac is hosting National Volunteer Week from April 15-19. We are focusing our efforts on our commitment to building financial confidence and bridging the gap in job opportunities for newcomers.

As record number of immigrants arrive in Canada, scammers are targeting newcomers navigating an unfamiliar financial landscape. In a recent Interac survey, we found only two in 10 (22 per cent) of newcomers polled strongly agreed they would know what to do if they were a victim of a financial scam, with nearly six in ten newcomers indicating being targeted makes them feel less financially confident.

This year, we hosted our first-ever Financial Confidence Summit, where 200 newcomers learned tips and resources to help stay in control of their money, protect themselves from fraudsters, and build their financial confidence through our Mindfulness & Money program in partnership with Conscious Economics and ACCES Employment.

Mindfulness & Money is a free digital literacy program available to all ACCES Employment members. This foundational digital learning platform supports the development of financial wellbeing skills through the lens of mindfulness, to newcomers coast-to-coast.

To conclude the summit, we hosted a speed mentoring session where Interac employees offered career advice to attendees seeking employment in fintech.

Our commitment to building financial confidence at Interac with Jeremy Wilmot, President & CEO, and Glenn Wolff, Group Head & Chief Client Officer

Navigating, understanding, and adjusting to a very new way of life in Canada can be very intimidating, which is why financial education is so important.

“We recognize the challenges that accompany starting anew in a foreign country, which is why we collaborate closely with community partners like ACCES Employment to bridge the gap, whether it’s increasing access to job opportunities or enhancing financial literacy skills,” said Jeremy Wilmot, President & CEO.

As newcomers establish roots and potentially build a future for themselves and their families in Canada, it’s essential they have the necessary tools to maintain control over their finances and cultivate financial confidence.

At Interac, we work with community partners to build financial confidence as new Canadians begin their journey. “I knew I wanted to be part of an organization that had a direct positive impact on people’s lives and the communities we serve,” Glenn Wolff, Group Head & Chief Client Officer, said.

Fostering financial confidence among newcomers is core to our social impact commitments.

Didn’t get a chance to attend the summit? We’ve got you covered with key learnings from the summit:

Who are we and what do we do at Interac with Vanessa Thomas, Lead, Product Marketing, Interac Verified

As you get settled into Canada, getting to know how the country’s financial system works can feel a little unfamiliar. Interac helps you transact digitally using your own money from your bank account, as well as helping to provide convenient access to government and business services that require you to prove you are who you say you are.

You may be wondering – what is Interac and how can it help me? Here are a few tips.

When you use our products and services, you can do it with confidence. Interac is one of Canada’s leading and most trusted financial services brands, thanks in large part to the security features built into its products and services.

How to stay safe online and identify scams targeting newcomers to Canada with Joanna Schoneveld, Leader, Fraud Management

According to a recent Interac survey, seven in 10 new Canadians feel they are more susceptible to financial scams than the general population, with over half indicating they or an immediate family member have been targeted by fraud.

Example scams Newcomers face in Canada

Stay safe online by using our recommended “Three S approach” when faced with financial fraud: Stop, Scrutinize, and Speak Up.

Stop: think and follow your instincts when you encounter a request for personal information.

Scrutinize: for signs of scams and be aware of common fraud, including unexpected phone calls, emails, or text messages.

Speak Up: seek help when faced with suspected fraudulent attacks or scam attempts to help defend yourself and others.

What is financial therapy and how can you stay in control of your money as you settle in Canada with Aseel El-Baba, Financial Therapist with Conscious Economics

Financial therapy helps people change how they think, feel, behave, and communicate about money. Aseel works closely with clients across Canada to heal their relationship with money so they can lead more fulfilling lives.

Aseel recommends trying some simple grounding techniques before making any choices concerning finances that can help you remain rooted in the present moment, shift your energy and focus on what you can control.

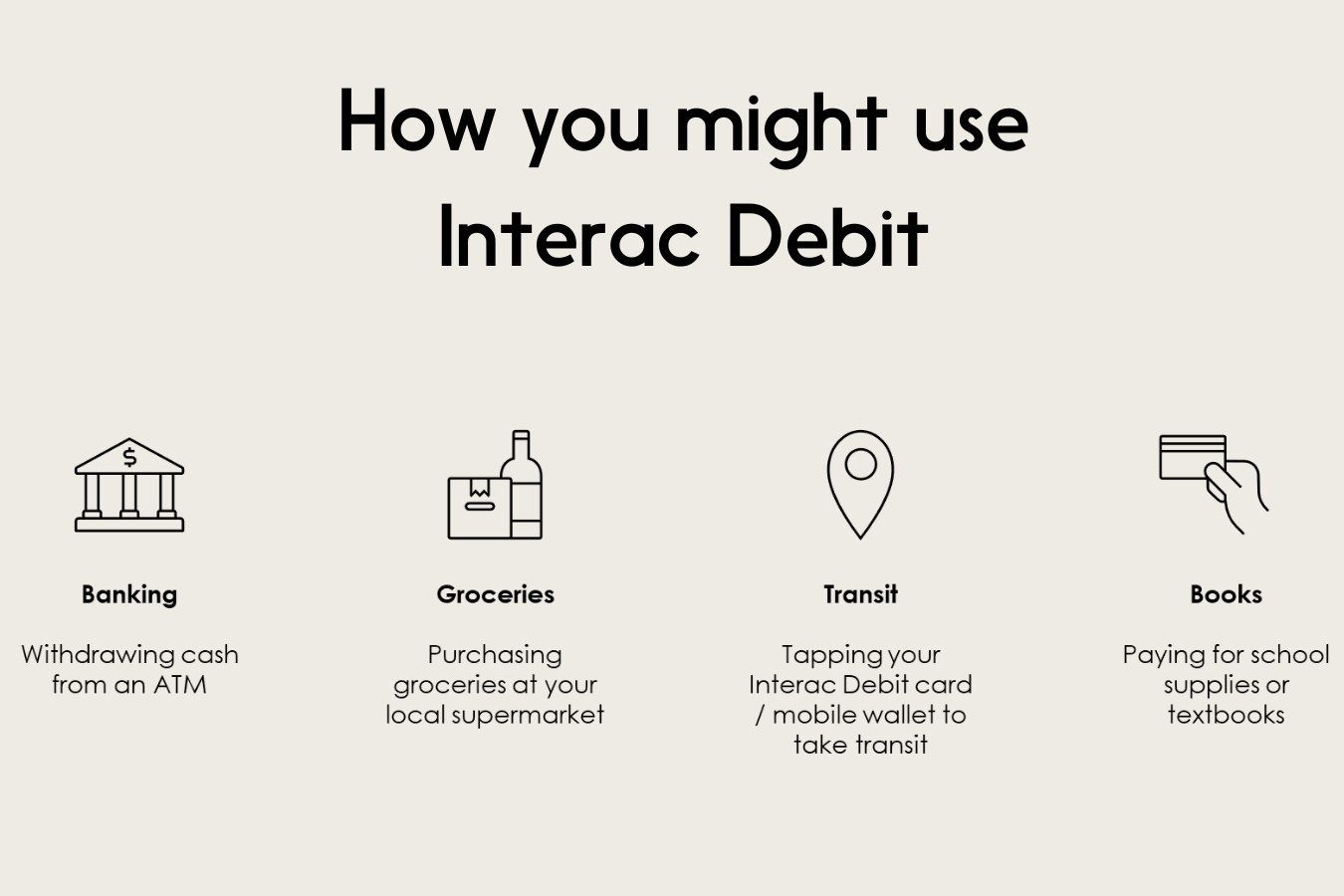

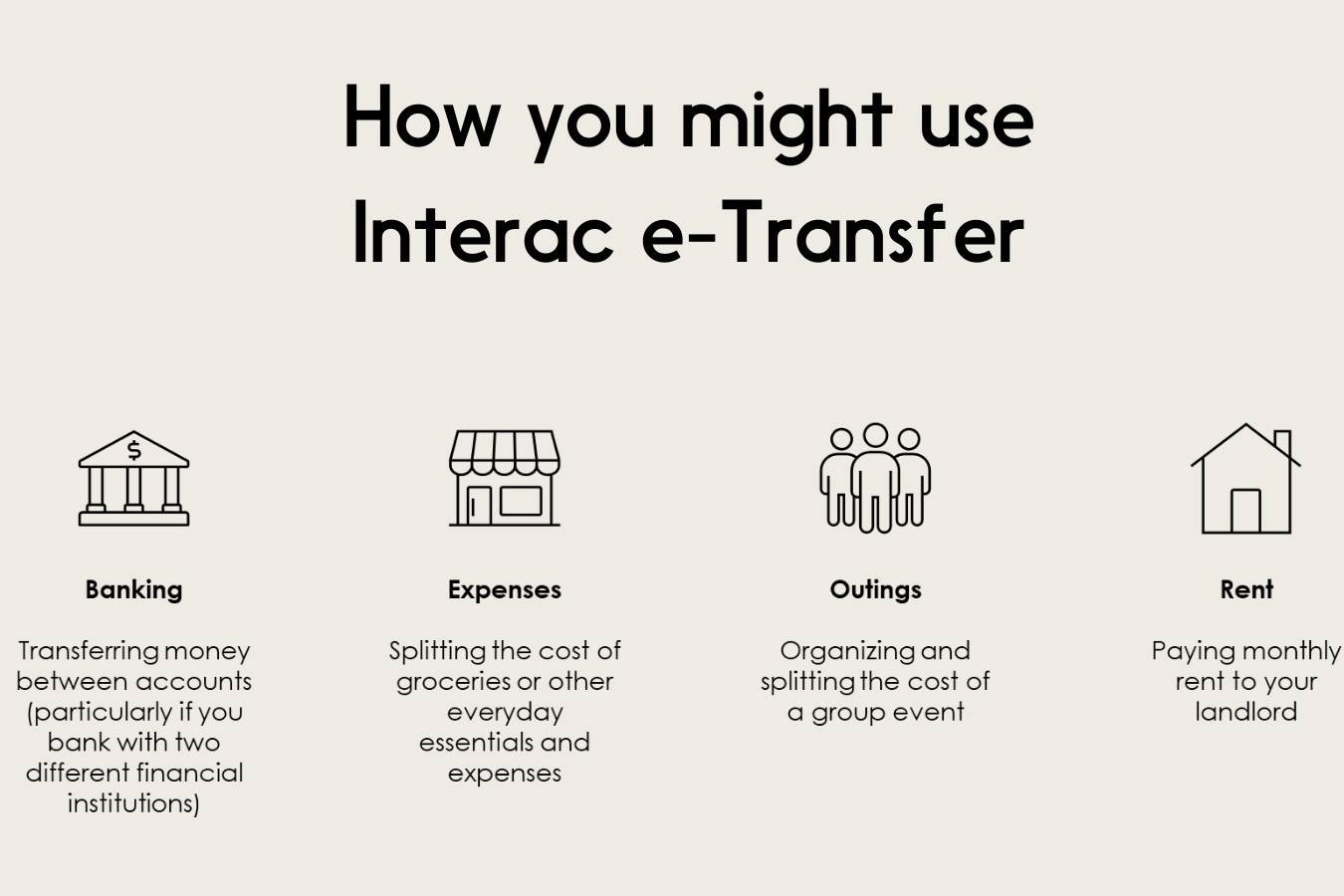

Additionally, spending in the here and now, with your own money, can help keep you grounded and reduce anxiety. Using products like Interac Debit, and Interac e-Transfer can help you feel more in control as you’re spending your own funds and not incurring worrisome debt.