Start and scale your business with resources to manage cash flow, avoid financial burnout and crush your goals.

You have questions, we have answers.

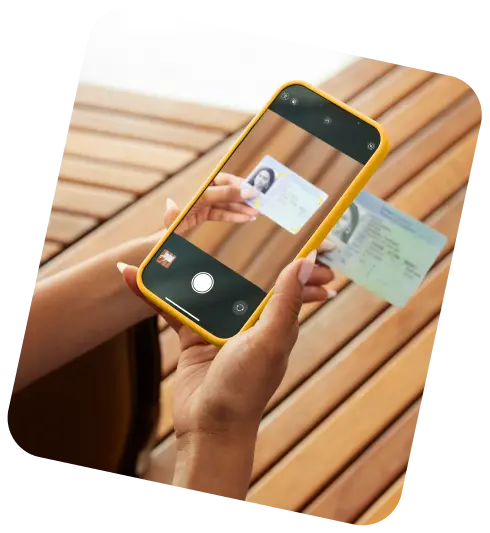

What's the most efficient way to get paid?

Learn more

How can I avoid financial burnout?

Learn more

How can I keep track of my business expenses?

Learn more

Ready to level up?

Learn how Interac can help

you grow your business.

We can help unlock your business potential

Interac provides solutions to help simplify and speed up your payments — so you can spend more time on building your business.

Get the free report

Let’s geek out and power your growth

Learn how meeting your customers’ evolving needs can help power your business’ growth. Take a deep dive on Interac solutions.

I’m ready to learn

Survey shows Canadians are embracing side hustles for passion and profit

Learn more

46%

of entrepreneurs do their side hustle work primarily to pursue a personal passion.

56%

say their side hustle turned out to be more fulfilling than they expected.

More than 6 in 10

entrepreneurs use Interac e-Transfer to make business-related payments.

Learn more

Mindfulness & Money: For Entrepreneurs

A digital learning program anchored in financial wellness provided by Conscious Economics in collaboration with Interac. The program is designed to be accessible for all; curated to support the development of financial wellbeing skills for entrepreneurs through the lens of mindfulness.

Learn more