We are living through an important moment in history where people are re-examining what brings them joy. Health, family and control over life are concepts that have taken on new meaning. And at a time when nothing feels certain, helping Canadians feel in charge of their own financial future is a powerful thing. That’s why I’m excited to introduce InLifeTM, the new Interac brand platform.

We’ve seen a foundational connection between control and financial optimism – it’s something we’ve built our brand on for 37 years. We know the importance of giving Canadians choice to pay and get paid quickly, on whichever device they choose. For 63 per cent of Canadians, being in control of their spending lets them feel more optimistic for their financial future. And in the context of 2020, with more than half of Millennials and Gen Z adults reporting they’re more concerned about managing their finances than ever before, optimism is a powerful thing.

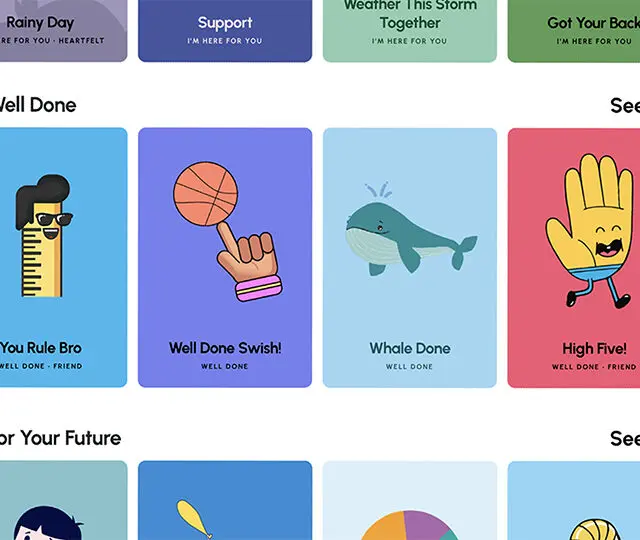

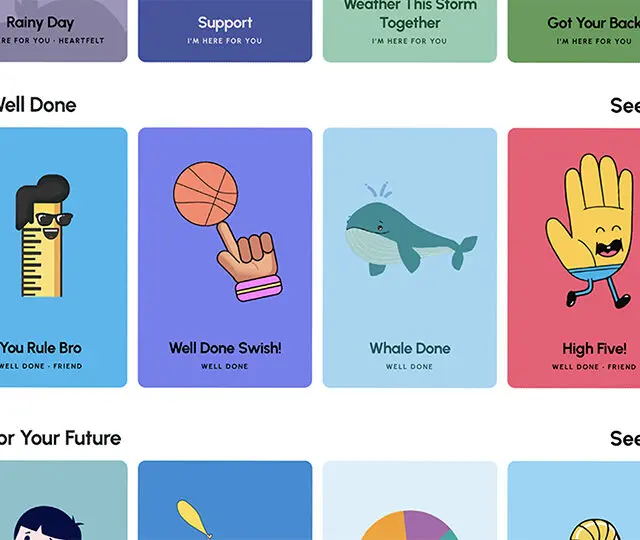

Amid a time filled with unpredictability, the InLife brand platform reflects how Canadians are living life to the fullest while staying in control of their money. That life will look different based on what matters most to you, and your current situation. It could be freelancing from home, or wherever home is that day, grabbing a bite to eat at your favourite hidden gem, starting your side hustle, or finding new homes for old treasures. InLife features stories of what we call an “Interac Life” – a life made freer, simpler and more enjoyable by using your own money, while living within your means.

If there’s one thing this past year has shown, it’s the importance of being able to transact conveniently while being physically apart from one another. The InLife brand platform sets the stage for the changing way Canadians are transacting digitally, whether paying for a bite on the go with Interac Debit contactless payments or getting paid for remote work with Interac e-Transfer.

We want Canadians to feel the independence, freedom and confidence that comes with being in control of their own money. The InLife brand platform, with its new tagline and refreshed brand identity, is a visual representation of that mission. That’s why we’ll continue to ensure Canadians can access, spend and send funds from wherever makes them the happiest in life.