Whether you’re a solitary freelancer or a business owner with a small but devoted staff, one thing is for certain: being your own boss is pretty awesome.

That said, there are some things about running your own business that aren’t so fun. After all, you’ve essentially chosen to play in ‘Hard Mode’ and it’s easy to find yourself juggling so many roles, jobs, and small tasks that knowing up from down can be difficult.

Often a good way to stay organized, for instance, is to create a sheet for each project with some all-important details like these:

Having all your details for the job is just one part of things, however, and in the freelance life one constant difficulty to tend with is the essential but time-consuming process of organizing your finances, paying for business essentials, and getting paid yourself. Fortunately we have some small business support with handy tips and tools to help you stay on top of your work, figure things out, and show you how Interac e-Transfer for Business can help you spend less time worrying about the next cheque coming in and more time being your own boss.

TIP #1: Stop Chasing Cheques – Let Your Money Chase You

While being a freelancer can give you a lot of freedom to run your business the way you want, sometimes it feels like half the job is trying to get paid and making sure the cheque is on its way to you.Even then, once you get the cheque there are long lines at the bank, processing times, and the uncomfortable vibe between you and your mailman, who has probably seen you get way too angry or way too happy when you open the mailbox.

Thankfully, from requesting money to sending and recieving payment, Interac e-Transfer for Business is there to cut down on the wait time. When using it with Interac e-Transfer Request Money, you can schedule automatic follow-ups so you don’t have to waste another second typing “just wanted to circle back on this!”. And when registered for Interac e-Transfer Autodeposit, your payment isn’t “in the mail”, it’s in your account!

TIP #2: Know the Comings and Goings of Your Money

As any freelancer or small business owner will tell you, when the “Busy Season” hits, it hits HARD. And when you’re in the middle of a rush with suppliers to contact and pay, multiple clients constantly emailing you, and many time sensitive jobs happening all at once, it can be difficult to figure out who owes what! Especially if you’re the only one doing everything. For that always remember that you aren’t alone and help, in more ways than one, is there if you need it.

Reach out for help

As a freelancer or small business owner it can be incredible to wear so many hats. But like everyone, you sometimes need a little help, particularly when it comes to finances. Being your own bookkeeper can help you keep the numbers balanced on your end, but professional accountants can help with filing your taxes, making sure the numbers add up, and even see if you’re entitled to benefits!

It’s in those ‘Jack of All Trades’ moments where Interac e-Transfer for Business can really make a difference, as payment details includingthe invoice and PO number are all contained within the payment itself! It’s such a simple feature, but one that can prevent some big headaches down the line when you’re trying to keep track of your records and prepare for tax season.

TIP #3: Work with Your Clients to Match Your Payment Style

Freelancers always have to be thinking about clients in one way or another and a lot of the time that thinking is about how to get new ones, a process that’s very time-extensive and involves a lot of research and outreach.

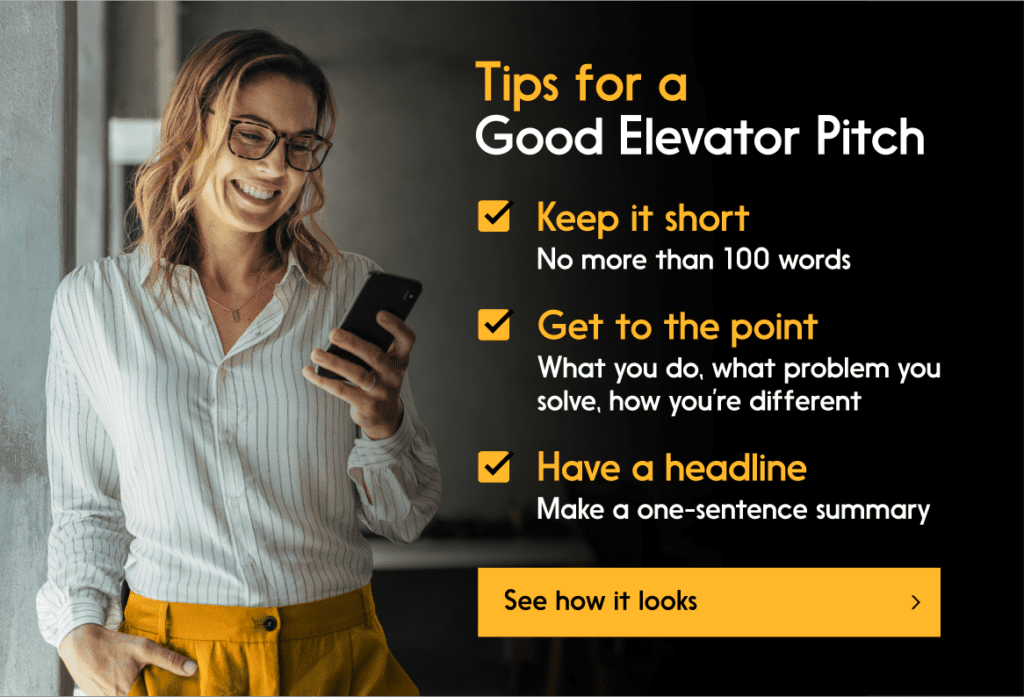

One way to save time for this is to create an elevator pitch for your business. The pitch is there to summarize what you do as quickly as possible and is a handy, easily remembered tool to have at the ready. Here are a few quick tips on how to make the best elevator pitch:

But once you have a new client, you then must put in the time to maintain a good relationship with the ones you have. And like all relationships with fantastic people, there are definitely times when things can get a little difficult with them. Particularly if you’re at the mercy of their payment methods or you find yourself needing to send more than a couple of reminders about paying their invoice.

Having a talk with your client about Interac e-Transfer for Business, particularly if they’re a long-time client, will save both of you a lot of time and headache. Registering is easy and fast, they can keep track of where their money is going by including invoice data in the transaction, allow them to maximize cashflow opportunities right up to the payment deadline, and account details or void cheques aren’t needed to make a payment (though they can be used). If they have your cell phone number or email address, they can pay you in a timely manner so both of you can move on to the next job. Include all that with the use of Interac e-Transfer Autodeposit, which allows you to send and receive payments in real-time with immediate confirmation and added security you just can’t get with a cheque, and your relationship with your client just got a whole lot easier to maintain.

Additionally, if you’re working on a particularly big project or get paid on a larger scale, Interac e-Transfer for Business can be an easy alternative to cheques or wire transfers with a high transaction limit that, depending on the financial institution, can be as high as $25,000.

If you or your client have some questions before talking with a financial institution, we’ve got you covered with a fast FAQ.

Q: How long does it take to activate Interac e-Transfer for Business?

A: If it’s for a business account, it could take a few days and if it’s a retail account you probably already have it activated and can start using it!

Q: I’m a pretty small business. Is Interac e-Transfer for Business right for me?

A: Along with the added benefits of the rich remittance data and high transaction rates with lower transaction fees, Interac e-Transfer for Business makes payments with any size business easier and is built to grow with you.

Q: Between buying supplies, paying bills, and purchasing table space to sell my product at events, I make a lot of payments in a very short amount of time. Does Interac e-Transfer for Business have a transaction limit?

A: Interac e-Transfer for Business is built for high volume commercial needs. The largest payments that can be made are $25,000 at a time, with no rolling (eg: weekly) limit. Talk to your bank about what limit they can provide you.

Q: Am I at a greater risk of fraud if I use Interac e-Transfer Autodeposit?

A: Not only does Autodeposit make payment quicker, it’s also more secure. With Autodeposit the payment is cleared instantly and avoids the possible risk of fraudsters taking advantage of a compromised email address by intercepting a transaction.

Do you think Interac e-Transfer for Business could be right for you? Contact your financial institution now to learn more.

And hey, we know sometimes reaching out can be the most intimidating part. So to help, we’ve put together a draft email you can customize to get the conversation started with your financial institution!